BLOG

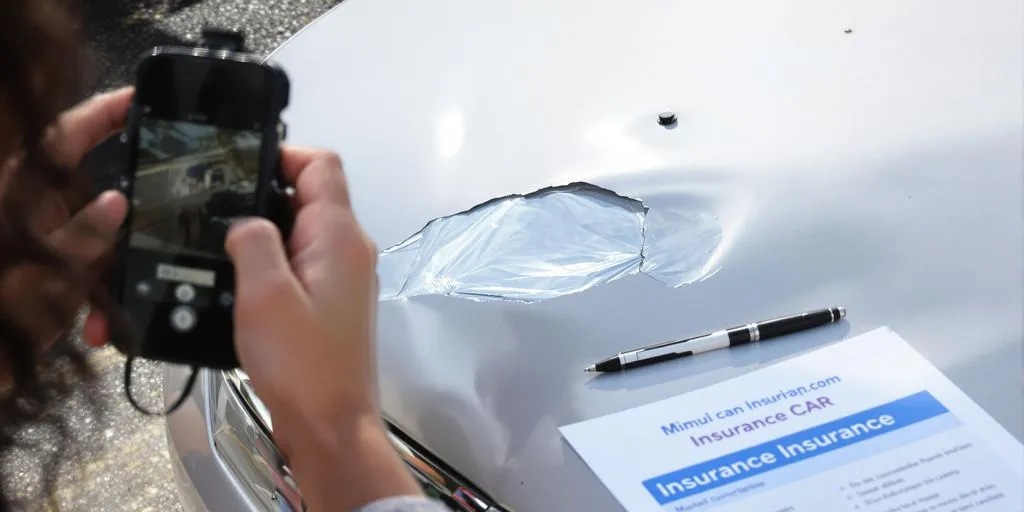

When you’re involved in a car accident, the aftermath can be overwhelming. Sorting through the paperwork, dealing with insurance companies, and arranging repairs can quickly become a headache. This is where accident management companies come into play. They take on the burden of handling your car insurance claims, making the process much smoother and less stressful for you. Let’s explore how these companies can actually help you after an accident.

When you find yourself in a car accident and your vehicle is out of action, you may need a replacement car to keep your life on track. That’s where credit hire cars come into play. These are vehicles you can hire when your own car is being repaired or if your insurance doesn’t cover a courtesy car. Understanding how credit hire works is crucial, especially when navigating the complexities of car insurance claims.

When it comes to car insurance, most people know it’s essential for covering damages and injuries resulting from accidents. But what happens if you find yourself in a legal situation after an accident, such as needing to go to court or dealing with disputes? This is where legal cover can step in to help. In this article, we’ll look at the ins and outs of car insurance and legal assistance, helping you understand when you might need it and what it can do for you.